Table of Contents

Why The Average Monthly Car Payment Keeps Increasing

It’s safe to say that Americans love their cars. So much that they are willing to pay over $500 a month to get around in their new ride. Americans now owe over $1.18 trillion in auto loan balances and the average monthly car payment is over $500 for new cars.

But what are the main reasons why the average monthly car payment been rising? The main reason the average monthly car payment keeps increasing is that new cars have been rising steadily in price over the last few years. Other trends leading to higher car payments are that people are rolling their previous car loan balance into a new car loan which increases the loan amount and the average monthly payment.

This isn’t just a problem for subprime loans, prime and super-prime loans loan amounts have also been steadily on the rise for years.

What Is The Current Average Monthly Car Payment?

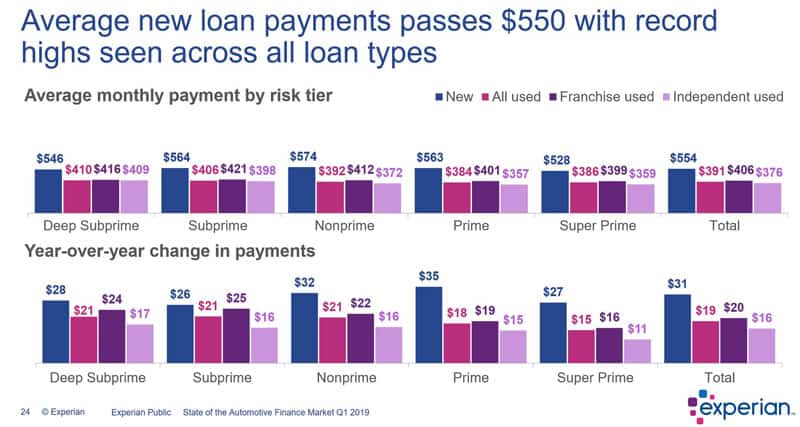

According to Experian, the average monthly car payment for new cars has now reached $554 a month car loans. This is a $31 addition from the same quarter last year. Prime rated loans are now at $563 new cars and $384 for used cars. Sub-prime loans are at $564 for new cars and $406 for used cars.

Source Experian Information Solutions

If that is the average monthly car payment for Americans is over $550 that means that there are plenty of people with a $700 or $800 a month car payment. Some people say that the next big crash won’t be the housing market again but the auto loan market as more and more people are getting in debt to finance their car loans. But what all makes up a monthly car payment?

What Makes Up A Monthy Car Payment?

The Loan Amount: The loan amount of a car payment is the amount of money left to be paid after factoring in the down payment and trade-in credit for your old car.

The Length of the Loan: The length of the loan is how long you have to pay off the loan typically expressed in months.

Interest Rates: The interest rate of the car payment will determine how much interest you have to pay each month on the loan balance.

| Average… | New cars | Used cars |

| Monthly payment | $554 | $391 |

| Loan amount | $30,977 | $19,861 |

| Interest rate | 5.73% | 9.03% |

| Loan term | 68.5 months | 64.4 months |

| Credit score | 714 | 661 |

Source Experian Information Solutions

It also seems like auto lenders have started to get more lenient on who they will loan money. The number of subprime loans has now started to increase which means that the interest rates on these loans will also be higher.

In the same Experian report, they say that the average interest rate for new cars is 5.73% while the average interest rate for used cars is at 9.03%. What is somewhat telling about this data is the credit score of the people signing up for these loans.

The average credit score for people purchasing new cars is 714. While the average credit score for people purchasing used vehicles is 661. This also starts to explain why the differences in interest rates between new and used cars.

The average loan amount seems to differ depending on what source you are getting the numbers from but both Experian and KBB say that the average loan amount of new cars is around $31,000 to $36,000. The average loan amount for used cars is around $20,000.

What is somewhat interesting about that data is that the average loan term still seems to be about the same between new and used cars. New cars averaged a loan term of 69 months while the average loan term for used cars was at 64 months.

This means that people are going with about the same loan terms regardless of if they are purchasing a new or used vehicle. Historically the loan terms of used vehicles have been shorter than new vehicles because of the loan amount for new vehicles.

However, those loan term numbers have started to inch closer and closer to each other in the past few years.

Reasons Why The Average Monthly Car Payment Keeps Increasing

1. Rising Car Prices

The number one factor in the average monthly car payments increasing over time is that the price for cars has also been steadily increasing. You used to be able to buy a brand new car for under $10,000 but nowadays the average new car price is above $36,000 according to this article on KBB.com.

With rising car prices people will usually have to take out more on their car loans to be able to pay for the new vehicle. The more money will need to be financed the higher your car payment will be depending on how long the terms of the loan are.

One thing that I advocate is to pay attention to how much you are financing and not to the specifics of how much your car payment will be. When you show up to purchase a new vehicle don’t tell the person selling you the car how much you want to pay per month tell them how much you want to spend on the vehicle.

Otherwise, the car salesman will just increase the terms of your loan to be able to get your car payment to a more reasonable level. While this may seem like he is doing you a favor in the short term this really means that you will be paying for the car that much longer.

2. Transferring Loan Balances

Another reason why average monthly car payments are on the rise is that people aren’t paying off their previous car loan before buying a new car. If you don’t fully pay off your old car loan then you will be forced to roll over or transfer the previous balance to your new car loan.

This typically results in that person owing more on their car loan than their car than it is actually worth. This sort of mentality is becoming more frequent in a society that wants everything right now. The thinking is it doesn’t matter if you can’t afford it, you can always pay for it down the line. This is overall a bad way of thinking.

Most people need a car to get back and forth to work and home. But you don’t need the latest car and have an exorbitant car payment if you are struggling to pay your bills.

If you get in a car wreck and total your car the insurance company will give you money for your car but only what your car is currently worth. Not the amount you still owe on your car loan. This can leave people on the hook for a car loan on a car that they no longer have.

If you currently have a car where your loan amount is substantially higher than what the car is currently worth then I would recommend gap insurance for your car. If your car gets totaled gap insurance essentially pays you the difference between what your car is worth and how much you have outstanding on your car loan.

That’s why it’s beneficial to have gap insurance if you are currently underwater on your car loan. To learn more about gap insurance check out my other article about it.

3. Higher Interest Rates

Interest rates have been on the rise in recent years which also attributes to the overall car monthly payment prices rising. The higher the interest rate on your loan the more you will be paying for the vehicle over the life of the loan.

Your credit score will have the biggest factor of what sort of interest rate you get on a car loan. The higher your credit score the more likely you will be to make your payments on time and pay back the loan. This means the higher your credit score the lower the interest rate you can expect to get from banks and other lenders.

If you have a lower credit score you will be less likely (in the eyes of banks and lenders) to pay back your car loan on time and in full. This results in a higher interest rate and a higher monthly payment, as well as more money paid overall during the life of the loan.

When interest rates increase you can expect the interest rates on auto loans to also increase regardless of if you are in prime or subprime credit score range. While your credit score definitely has a factor in what sort of rate you can get with an auto loan so does the general economy. If the economy is doing well the federal reserve will start to raise the interest rates it charges to borrow money.

4. New Car Technology

One of the biggest factors in the rising car prices of new cars is the amount of new safety technology that they are being equipped with. New safety technology like lane keep assist, automatic emergency braking, and blind-spot monitoring systems add to the overall costs of new vehicles.

Cars are coming equipped with more airbags to be able to protect occupants in a crash. Any new airbag systems equipped to cars are going to drive the price up. This technology is in the best interest of people buying cars but this new technology is definitely a factor in why new car prices have been on the rise in the past few years.

Safety features aren’t the only reason that new car prices are on the rise. New technology like touch screens and digital dashes are also some reasons why new car prices are going up. Lighting technology like LED headlights and bi-xenon headlights are also pushing the prices of new cars up.

5. Subprime Loan Interest Rates

Another somewhat common thing that people are doing is purchasing cars with subprime loans. A subprime loan is a loan that a bank is willing to give to someone that may not have a great credit score or has a history of making late payments.

Because of the risk involved with lending money to this person, the interest rate on the loan will also be higher than if that person had a good credit score. Interest rates on these sorts of loans can get into the 18-20% range which can be a big chunk of the total monthly payment.

I would advocate against financing a car with a subprime loan under most circumstances. The amount of money that you will be paying over the life of the loan in interest is not worth it in the long run. If you have bad credit and don’t have enough cash on hand to purchase a car you are better off purchasing a cheaper vehicle, saving up more money to purchase the car outright, or taking the time to increase your credit score.

Usually, with transportation people don’t have the luxury of waiting around to fix your credit score so purchasing a cheaper vehicle is the better option at the time. You can always buy a cheap car with cash and then continue to save up your money to purchase a nicer vehicle down the line.

6. Down Payments are Lower

With the increasing prices on new vehicles, this also means that the down payments on vehicles will typically be lower in relation to the overall cost of the vehicle. While most people are able to save up $2,000-$5,000 for the down payment on a vehicle.

If the cost of new cars continues to rise that same down payment isn’t going to make that much of an impact on the overall cost of the vehicle. If the costs of new cars continue to rise people are going to have to start to make higher down payments to make the same sort of impact on their car loan.

Some people may just say well this is just how inflation works and while I will agree that is a factor the prices of new cars have increased astronomically in the past decade. Inflation isn’t the only factor in car prices rising.

Having a higher loan amount will definitely affect how much the average car payment is for new and used vehicles. The higher your loan amount the more you will have to pay over the life of the loan to eventually pay all of that money back to the bank.

If you are interested in checking out how much your down payment has a factor in your overall loan payment cars.com has a car payment estimator that can give you an estimated car payment based on how much you put down as the down payment and what interest rate you think you would qualify for.

In Conclusion

There are many different factors as to why new car prices have been on the rise in the past decade. New car prices have been on the rise in the past few years. Interest rates have also been on the rise because of the booming economy.

Since the last financial crisis, auto loan lenders have started to get more lenient on who they will give loans to. This means that more people are able to get loans for cars where they previously may have not been approved by the bank.

Because these people may not have the best credit score they will typically have a higher interest rate on their loan than somebody with an 800 credit score. This means that a person with a 600 credit score will pay more overall for the same loan than someone with a 600 credit score.